You get a message from a landlord or realtor asking for your payslip, bank statements, and job letter. Your first thought? “Is this even legal?” The short answer is yes – but there are important rules about when, why, and how landlords can request your financial information in Jamaica.

When It’s Legal for Landlords to Request Financial Documents

Landlords have legitimate reasons to verify your income and employment, but timing and context matter.

During the Rental Application Process

This is when financial requests are most appropriate and legal:

Standard documents landlords can request:

- Recent payslips (usually last 2-3 months)

- Job letter or employment verification

- Bank statements showing income deposits

- Previous landlord references

- Government-issued ID

- Emergency contact information

Why this is reasonable: Landlords need to verify you can afford the rent and are a reliable tenant. This protects both parties from financial problems later.

Before Lease Signing

Pre-approval financial checks are normal when:

- You’ve viewed a specific property

- You’re ready to submit a formal application

- Landlord has provided clear rental terms

- There’s a structured application process

Red flag timing: Asking for financial documents before showing you any property or providing basic rental information.

When Financial Requests Become Suspicious

Be cautious if landlords ask for financial information:

Without Proper Context

- No specific property mentioned

- Vague about rental terms or location

- Requesting documents via casual social media messages

- No formal application process or paperwork

Too Early in the Process

- Before you’ve expressed serious interest

- Before viewing any properties

- During initial inquiry calls or messages

- Without providing their credentials first

With Unusual Urgency

- “Send documents immediately”

- “Limited time offer, need info today”

- Pressure tactics or threats about losing the property

- No time given to verify their legitimacy

Via Informal Channels

- Text messages from unknown numbers

- Social media DMs from unverified accounts

- Email addresses that don’t match business names

- Phone calls without prior appointment

What Information Can Landlords Legally Request?

Legitimate financial verification includes:

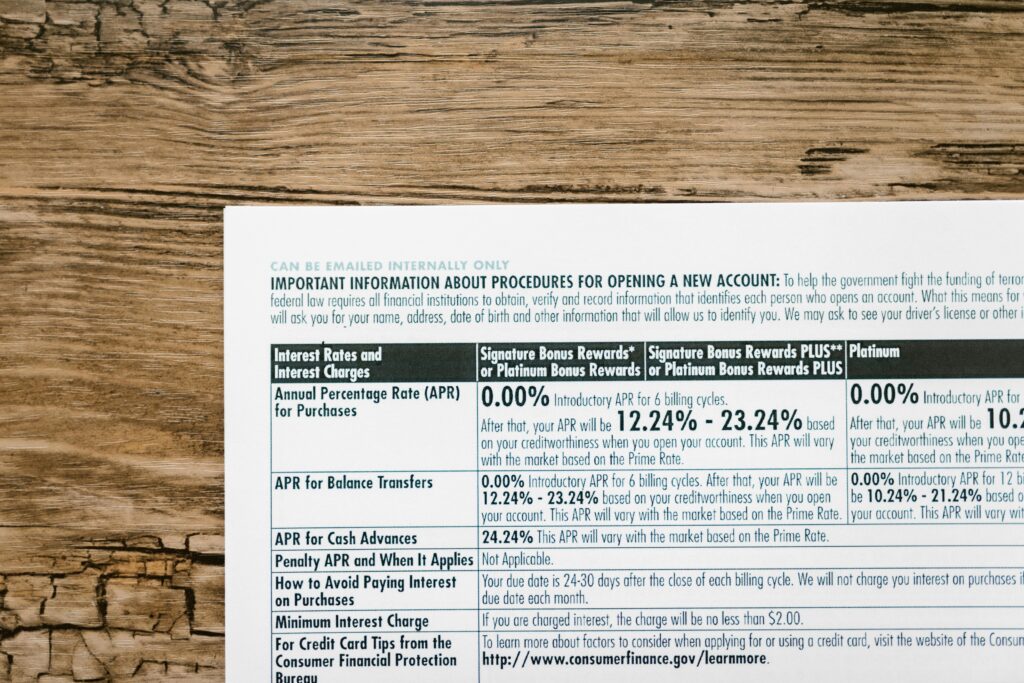

Income Documentation

- Payslips: Usually last 2-3 months to show consistent income

- Employment letter: Confirming job title, salary, and employment status

- Bank statements: Showing regular deposits and account balance

- Tax compliance certificate: Proving you’re up to date with taxes

Additional Verification

- Previous rental history: Contact info for past landlords

- References: Personal or professional character references

- Credit check consent: Permission to verify credit history

- Emergency contacts: Someone to reach if problems arise

What They CANNOT Demand

- Access to your actual bank accounts

- Passwords or login information

- Financial information from family members (unless they’re co-signing)

- Documents unrelated to rental application

- Information beyond what’s needed to verify rental capacity

Understanding your financial privacy rights is just as important as knowing the eviction process in Jamaica.

Red Flags: When to Walk Away

Trust your instincts if you encounter:

Scammer Behaviors

- Requesting Western Union or wire transfers

- Asking for deposits before viewing property

- Refusing to meet in person or show ID

- Property photos that look too professional or generic

- Prices significantly below market rate

Unprofessional Practices

- No business registration or credentials

- Unwilling to provide references or past tenant contacts

- Evasive about property details or lease terms

- Requesting excessive personal information

- High-pressure tactics or artificial urgency

Privacy Violations

- Asking for information beyond rental needs

- Requesting financial details of other household members

- Demanding access to social media accounts

- Asking inappropriate personal questions

- Refusing to explain why specific documents are needed

How to Protect Yourself

Before providing ANY financial information:

Verify the Landlord’s Legitimacy

- Ask for business registration or credentials

- Request references from current/past tenants

- Verify property ownership through public records

- Meet in person at the actual property

- Get everything in writing

Use Safe Sharing Practices

- Never email sensitive documents to unverified addresses

- Use secure document sharing platforms when possible

- Watermark documents with “For Rental Application Only”

- Keep copies of everything you provide

- Set up alerts on your accounts after sharing information

Ask the Right Questions

- “What specific property is this application for?”

- “Can you provide your business registration?”

- “What’s your standard application process?”

- “When can I view the property?”

- “Can you provide references from other tenants?”

Landlords who ask for inappropriate financial information often have other boundary issues too – Is the landlord responsible for repairs in Jamaica?

What Legitimate Landlords Should Provide

Professional landlords will offer:

Clear Application Process

- Written application forms

- Explanation of required documents

- Timeline for approval decisions

- Clear rental terms and conditions

- Professional contact information

Transparency

- Business registration or credentials

- Property viewing appointments

- Written lease agreements

- Clear deposit and fee structures

- Contact information for questions

Steps for Safe Financial Document Sharing

Follow this process to protect yourself:

Step 1: Initial Verification

- Verify the landlord’s identity and credentials

- Confirm the property exists and they own/manage it

- Get clear information about rental terms

- Schedule an in-person property viewing

Step 2: Formal Application

- Complete written application forms

- Provide financial documents only after viewing property

- Use secure methods for document transmission

- Keep detailed records of what you’ve shared

Step 3: Documentation

- Get receipts for any application fees

- Keep copies of all communications

- Document viewing appointments and interactions

- Save all application materials

When to Seek Help

Contact authorities if you encounter:

- Suspected rental scams or fraud

- Landlords demanding inappropriate information

- Pressure tactics or harassment

- Requests for unusual payment methods

- Any situation that feels unsafe or suspicious

Resources for tenant protection:

- Consumer Affairs Commission

- Real Estate Board of Jamaica

- Local police for suspected fraud

- Legal aid societies for tenant rights questions

The Bottom Line

Landlords in Jamaica can legally request financial information, but legitimate requests come with proper context, professional processes, and reasonable timing. Your financial privacy matters, and you have the right to verify landlord credentials before sharing sensitive documents.

Key protective measures:

- Always verify landlord legitimacy first

- Never provide financial information without seeing the actual property

- Use secure methods for document sharing

- Trust your instincts about suspicious requests

- Keep detailed records of all interactions

Remember: A legitimate landlord understands your need for caution and will respect proper verification processes. Anyone rushing you or refusing to provide their credentials is likely not someone you want to rent from.

Stay informed, stay safe, and don’t let anyone pressure you into sharing financial information without proper verification and context.